IFC Markets Review year : Is It a Good Broker or Not?

✅Send the specified amount from your cryptocurrency wallet to the copied address. Depending on network confirmation timings, deposits usually reflect within minutes to 24 hours. Furthermore, IFC Markets is a constituent of the IFCM Group, a conglomerate encompassing various entities subject to regulation and licensing by different international bodies. These include the European CySEC, the Labuan FSA, and the National Bank of Georgia. These regulatory bodies impose more stringent criteria concerning aspects such as capital adequacy, reporting, auditing, and investor compensation mechanisms. IFC Markets is regulated and licensed by a few international organizations, such as the European CySEC and BVI FSC.

Can I trade on mobile devices with IFC Markets?

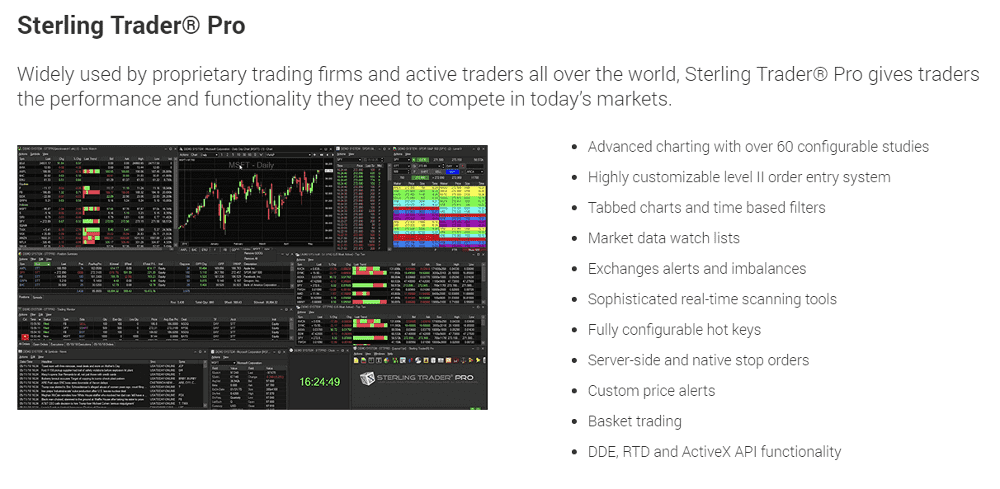

This account is completely free from swap charges, ensuring compliance with ethical financial standards prescribed by Islamic law. For traders needing advanced analytical tools and cutting-edge trading technology to execute complex strategies, the MT5 Standard Account is a great option. IFC Markets’ solid technical infrastructure enables lightning-fast order execution across platforms such as NetTradeX and MetaTrader 4 and the freedom to participate in different trading strategies such as scalping and hedging. Rates, terms, products and services on third-party websites are subject to change without notice. We may be compensated but this should not be seen as an endorsement or recommendation by TradingBrokers.com, nor shall it bias our broker reviews.

What types of trading accounts do IFC offer?

We do not provide financial advice, offer or make solicitation of any investments. The best broker for forex trading depends in large part on your needs and preferences. IFC Markets would be a decent choice for many traders, although you would not qualify to open an account with that broker if you’re based in the U.S. or Russia. One of IFC Markets’ most notable features is its proprietary GeWorko Portfolio Quoting Method that allows you to create and trade your own financial instruments.

IFCMARKETS. CORP.

Conversely, withdrawals may take slightly longer, ranging from 1 to 5 business days, contingent upon the chosen method. Importantly, IFC Markets refrains from imposing any fees on deposits or withdrawals. Nevertheless, it’s important to note that certain payment providers may impose their own fees, which lie beyond IFC Markets control. The minimum deposit threshold varies depending on the chosen account type, with the Beginner account setting it at a mere $1, while the Standard account requires a minimum deposit of $1000. On the withdrawal front, the minimum amount stands at $1 for e-wallets and $3000 for bank transfers.

Nettradex Limited

It streamlines the creation of Personal Composite Instruments (PCIs), enabling investors to craft bespoke investment portfolios while augmenting their analytical capabilities with advanced charting tools and expert technical analysis. Furthermore, this platform offers potent charting mechanisms and an extensive suite of indicators enabling comprehensive market research, making it highly coveted among forex and CFD traders. The MT4 offered is renowned in the trading community for its resilience and reliability. It boasts diverse technical analysis tools, algorithmic trading capabilities, and expert adviser utilization capacities.

IFC Markets User Experience

The quizzes serve as a litmus test of traders’ comprehension and knowledge retention. Overall, IFC Markets qualifies as an excellent choice among currently available forex and CFD brokers, and while it lacks a major regulator, it does have 3 minor regulators. If you’re into forex trading and are looking for an online forex broker that also allows you to trade other assets via CFDs, then IFC Markets would definitely be worth checking out. The broker has won 8 international awards in a number of categories over the last 2 years primarily for its services provided in the Asian and Southeast Asian forex and CFD markets. IFC Markets also provides a trading service in Canada and compares favorably to other Canadian forex brokers. Traders open new accounts via a brief four-step online application, the final two consisting of a deposit and trading platform download.

The broker has adopted a commission-free trading model that may be particularly attractive to traders with high transaction volumes. This approach simplifies the cost structure, allowing traders to focus on spreads as their primary trading expense. For instance, NetTradeX Standard and Beginner accounts feature floating spread rates as low as 0.4 pip. In contrast, fixed spread rates can go to 1.8 pips – an affordable choice providing consistent pricing transparency that seasoned traders value. The broker provides a variety of account types, including Standard, Beginner, Micro, Demo, and Islamic accounts, each designed to satisfy the unique needs of traders. TradingBrokers.com is for informational purposes only and not intended for distribution or use by any person where it would be contrary to local law or regulation.

https://forexbroker-listing.com/ is based in Cyprus and has global offices, including one in the British Virgin Islands, demonstrating its international presence in the trading community. The broker provides educational tools, including webinars, articles, and tutorials, and you can also visit their official website and contact customer service for more information. IFC Markets is a safe broker, licensed by the BVI FSC and LFSA, and uses a variety of safeguards, including segregated accounts and indemnity insurance. This valuable feature effectively safeguards clients from losing more than their initial investment and precludes them from incurring a debt with the broker during periods of substantial market instability.

ifc markets review allows you to trade 50 currency pairs with instant execution, 400 + CFDs on stocks and indices, 19 commodity futures and CFDs on cryptocurrency futures. Customer security is provided in a variety of ways, including segregation of customer funds and participation in the company’s bankruptcy compensation Fund. IFC Markets has catered to clients for more than 15 years and complies with three regulators. It is a legit international multi-asset broker with a clean regulatory track record. All financial transactions take place in the secure back office of IFC Markets.

With more than 25,000 available plugins and EAs, traders can transform MT4 into a cutting-edge trading solution, but traders must purchase them, as the free ones hardly function as advertised. Traders at IFC Markets have three distinct choices, with options for each, plus a demo account. Yes, leverage is available for various instruments, but more leverage magnifies both possible profits and losses, raising risk.

By offering micro-lot trading, this account also allows new traders to gain experience through smaller transactions rather than bigger ones, making it a perfect learning platform. Additionally, a minimum investment of only $1 and fixed and floating spreads are required, allowing beginners to grasp the market’s workings without much risk. While IFC Markets does not have its own mobile app, all of its supported trading platforms, (MT4/5 and NetTradeX) have iOS and Android mobile and tablet versions. In addition, you can get VIP status, which will give you flexible trading conditions, exclusive tools, free access to VPS, no fees for deposits and withdrawals, and much more. The rate depends on the monthly trading volume, rewarding active traders with transactions exceeding 10 lots monthly. High-frequency traders may benefit from this passive income offer and offset swap rates on leveraged overnight positions.

Developed by IFC Markets, this platform is acclaimed for its intuitive interface that accommodates beginner and seasoned traders. ➡️Synthetic Instruments – Over 30 synthetic instruments are available through the Portfolio Quoting Method, which allows traders to construct and trade their composite instruments (PCI). ➡️Crypto CFDs – ۱۵ crypto CFDs are available, allowing traders to participate in the cryptocurrency market. The Islamic Account has been specially designed to cater to the needs of traders who prioritize Sharia compliance in their transactions.

- IFCM offers several trading accounts with fixed or floating spreads for each of the trading platforms.

- These funds are meticulously held in segregated accounts with reputable financial institutions like HSBC, RCB Bank, and Bank of Cyprus.

- Therefore, traders must devise an optimal capital management strategy to minimize transactional expenditures effectively.

- The options available include fixed and variable spreads, with rates varying depending on the type of account selected.

No, the broker is transparent, revealing all potential trading fees upfront, including spreads, overnight fees, and any deposit or withdrawal charges. The IFC Markets website provides detailed information on spreads and fees in the trading conditions section for each financial instrument. It is prudent for traders to recognize these fees as undertaking frequent deposits and withdrawals could culminate in substantial expenses over time. Therefore, traders must devise an optimal capital management strategy to minimize transactional expenditures effectively.

Regarding how IFC Markets compares to its competitors, very few forex trading platforms and CFD brokers offer as many advantages as IFC that include the ability to create your own synthetic trading instruments. Plus, if you fund a trading account, you qualify to win one of the great prizes offered by the broker. Choosing IFC Markets can make sense whether you’re a novice trader or have years of trading experience. The main downside of this broker relative to some of its competitors is that it lacks a major regulator, although it is overseen by 3 minor regulators. In addition to providing top-quality trading platforms that include MT4/5, the broker provides an impressive market education section on its website. Other advantages include Islamic accounts, an extensive analytics section and a free demo account so you can gauge IFC’s offerings and practice your trading.

IFC Markets caters to most international traders, including residents of the UK, Canada, and South Africa. Since IFC Markets explains its products and services well and ensures flawless operations, I doubt traders will require customer support. The overall quality and presentation are acceptable and will offer manual traders new ideas to consider. IFC Markets recently added two sections, Trading Ideas, and Technical Summary, featuring short-format trading signals. Furthermore, accompanying this is a stop-out level which facilitates automatic liquidation of open positions by brokers if the account hits specific loss levels, thereby preventing negative balance situations for traders.