Accounts Receivable Automation: What, Why, & Top Benefits of Automating Your AR Process

This will help you set clear objectives about what you want to achieve with AR automation software. This enabled them to effectively manage their extensive account portfolio and reduce the volume of overdue invoices, resulting in improved financial performance and a better customer experience. With built-in structured workflows, Shurtape was able to resolve deductions quickly, while automated worklist prioritization ensured accurate account targeting. HighRadius’ product also provided POD backup and claim automation, which streamlined processes even further. AR automation ensures seamless end-to-end automation across the order-to-cash process, connecting all teams and enabling real-time data flow. For example, collections analysts receive instant updates about invalid deductions or blocked orders, allowing them to prioritize collections efficiently.

Make collections a trulycollaborative team effort

Effective customer segmentation and proactive credit checks can further reduce payment delays by several days. Implementing SMS reminders and Auto-call features has led to customers getting paid 27 days faster on average, resulting in a total reduction of 38 days to payment. An automated accounting system enables the collection, storage, and processing of financial data that business professionals can use to make key decisions. In addition to these advantages, automated accounting with a cloud-based software solution is much more secure. As you know, keeping financial data safe is essential because of the increase in cyberattacks over the last decade.

Find the best Accounts Receivable Software

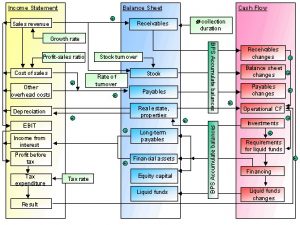

Standout features include all-in-one functionality for invoicing and basic accounting, as well as built-in time tracking, professional invoicing, and integrated payments. Accounts receivable refers to a business’s outstanding invoices or the money customers owe that business. This financial term, represented by a line item on a business’s balance sheet, indicates the total amount due from customers for products delivered or services rendered but not yet paid for. When a business provides a product or service and lets the customer pay later, the amount the customer owes is recorded as accounts receivable.

Key features

This encompasses a range of activities, such as generating invoices, sending payment reminders, reconciling incoming payments and producing financial reports related to receivables. Chaser’s Receivables area offers a CRM of all your debtors, drawing data from your accounting system. This allows you to focus on problematic customers and take necessary actions to ensure timely payments. You can set and adjust credit limits, guided by automated alerts, and log all debtor communications for a comprehensive overview. Early adopters of the AI payer ratings feature have seen their days sales outstanding reduce to just four days, representing a 76% reduction in days to pay.

Autonomous Finance Platform

You can see exactly what your business’ return on investment would be from using a tool like Chaser to protect and bring your revenue in faster. Go to the ROI calculator here, plug in yours or your clients credentials, and you can instantly see your yearly time and cost savings – as well as the monthly cost of delaying using AI and automation. These success stories highlight the tangible benefits of AI and automation, showing that with the right tools, businesses can achieve significant improvements in their AR processes.

Key qualities to look for in accounting software

HighRadius is revolutionizing the future of accounts receivable management by offering end-to-end integrated receivables automation solutions that break down silos across A/R teams and optimize financial health. AR automation, or https://www.accountingcoaching.online/accounting-205-vocab-flashcards/, revolutionizes the accounts receivable process by automating the tedious and time-consuming tasks accountants typically handle. This not only simplifies the workload for your company’s accountants but also accelerates payment collection from customers. Customization is a key feature of many AR automation solutions, allowing businesses to tailor the software to their unique processes and industry requirements. Invoiced offers a straightforward accounts receivable software that automates billing, collections, payments, and reporting within a single, digital platform.

Its Intelligent Document Processing (IDP) cuts short processing times and prevents fraud while delivering up to 99.5% processing accuracy without any manual input. You will find that QuickBooks accounting software checks all these boxes—plus much more. Create workflow rules to secure your decisions and automate the approval process when necessary (credit reviews, deductions validation, etc), as per your credit policy. Easily address the most common business scenario to accelerate resolution (creating a claim from a short payment, requesting a collection call to release a block order, etc.). Create and assign tasks from disputed invoices to accelerate the dispute resolution process. Once you’ve shortlisted a few vendors, the next steps would be to touch base with them via email, chatbot, or social media to understand their offerings better and start a conversation.

The need to balance assertive collection efforts with maintaining customer goodwill. For more corporate finance insights, sign up for our newsletter to get the latest tech industry wage expense definition & example news and advice from financial leaders. Integrations include other BlackLine products along with ERP systems from NetSuite, SAP, Oracle, Microsoft Dynamics, and more.

By leveraging artificial intelligence and other sophisticated functions, accounting software can do everything from tracking and recording transactions to generating financial statements. This means that repetitive tasks like data entry and checking calculations are taken care of, so accounting professionals can focus on big-picture duties. Automated accounting is the use of software to complete traditional accounting tasks.

- Sign-up pages offer customers the ability to agree to contract terms as part of the invoicing process.

- Here are some key takeaways from that session, along with some additional insights and next steps you can take to incorporate AI into your finance team’s operations, and improve your receivables management.

- This comprehensive visibility allows senior A/R leaders to assess process health and analyze analyst productivity metrics, facilitating course corrections and strategic decision-making.

- Integration across your revenue stack ensures a smooth data flow between different stages of the O2C process.

- This encompasses a range of activities, such as generating invoices, sending payment reminders, reconciling incoming payments and producing financial reports related to receivables.

By not trying these methods, you could essentially be waiting an extra 38 days to receive the invoice payments you are owed, completely unnecessarily. Furthermore, it appears to be commonplace for businesses to accept these late payments as simply part of ‘business as usual’, and delay proactively dealing with late payments until they become bad debts. On average, businesses right now are writing 8% of their revenue off as bad debts every single year (Hilton Baird). That is revenue sacrificed that could be reinvested in business growth, or protecting your cash flow. Automated Accounts Receivable software is designed for global organizations thanks to support of multi-languages, multi-sites, multi-currencies, worldwide payment coverage and global compliance. What’s more, the cloud-based nature of the solution enables different teams to collaborate more effectively while giving executives the visibility they need at every level of the organization.

Some legacy AR systems are notoriously difficult to use for new users, so I focused on tools with intuitive UIs and good ratings for usability. Fortunately, AR automation tools generally require less ongoing maintenance once workflows have been established and the solution is fully integrated and deployed with existing systems. Standout features of Bill include the combination of AR and AP in one platform, which helps managers oversee a more complete financial picture of money coming in and out.

Simon Litt is the Editor of The CFO Club, where he shares his passion for all things money-related. Prior to editing this publication, Simon spent years working in, and running his own, investor relations agency, servicing public companies that wanted to reach and connect deeper with their shareholder base. Simon’s experience includes constructing comprehensive budgets for IR activities, consulting CEOs & executive teams on best practices for the public markets, and facilitating compliant communications training. This guide highlights how AR automation solves 15 common challenges; it also shares the impact Versapay could have on a hypothetical enterprise.

SoftLedger is a comprehensive cloud accounting platform that has custom solutions for a wide variety of business sizes. It offers integrated bank and credit card feeds, automated invoicing, and custom invoice formatting. https://www.accountingcoaching.online/ software refers to digital solutions used to facilitate the invoicing process, tracking of payments, and optimization of the overall accounts receivable workflow for businesses. Automated accounts payable software helps businesses pay their bills on time through various payment methods, reducing errors and improving trust with suppliers and vendors. It digitizes the supplier/vendor invoice and bill process to create leaner, cost-effective, and faster workflows. Thus, no manual forwardings, no cutting paper checks, and no paper receipts anymore.